Behind the Budget: MARSP’s Push for MPSERS Funding Security In February, the Governor shared her initial budget recommendations, which set aside $1.7 billion for…

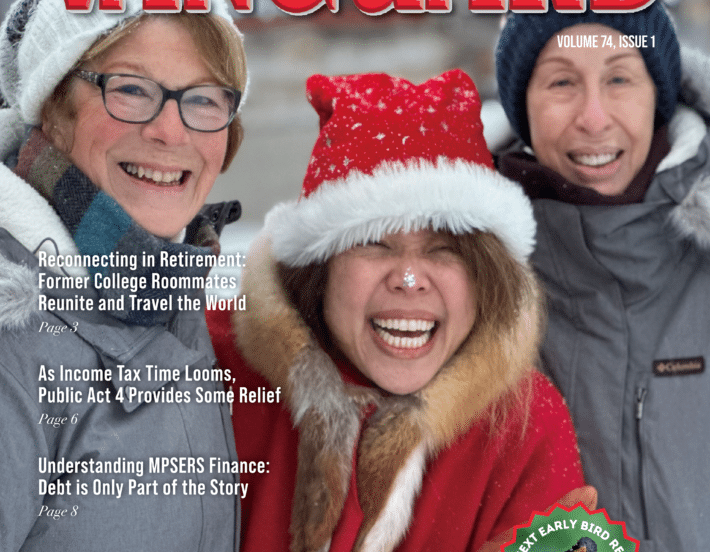

The Winter 2024 issue of VANGUARD is now available online! Page through online Download this issue Inside this issue: Reconnecting in Retirement: Former College…

Members Only

This content is available for MARSP members only.

Members Only

This content is available for MARSP members only.

Members Only

This content is available for MARSP members only.

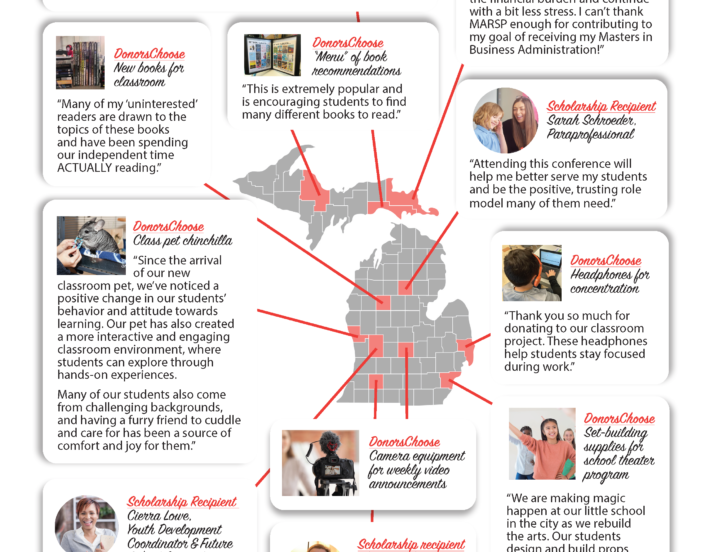

MARSP Members Make a Difference! As we close another year, MARSP and the MARSP Foundation are reflecting on the generosity of members and supporters…

Interested in learning more about MARSP?

We would be happy to discuss membership benefits with you.