Understanding MPSERS Finances: Debt is only part of the story

Part of MARSP’s mission is to inform members of legislative developments that could affect their livelihoods. This involves monitoring the Michigan Public School Employees’ Retirement System (MPSERS). MPSERS is the branch of the Michigan government that manages public school retirement pensions, healthcare benefits, disability, and survivor benefits.

In VANGUARD and other MARSP sources, you’ll occasionally see references to “MPSERS’s debt.” While the meaning may seem obvious, MPSERS’s financial picture is complex. That said, a basic understanding can be helpful, especially when perusing retiree news. So as we begin another year of advocacy, let’s take a closer at this complicated element of the retirement system.

To better understand MPSERS’s financial picture, let’s look at its funding and costs.

MPSERS Costs & Funding

MPSERS revenue streams consist of the following:

- Investment earnings: The State of Michigan’s Bureau of Investments (BoI) invests MPSERS’s considerable financial resources. This is by far the greatest source of MPSERS funding, with roughly two-thirds of each dollar paid in retiree benefits coming from investment returns.

- Employer contributions: Each year, school districts (employers) remit a percentage of their total payrolls to the state for MPSERS funding. Three components make up the percentage: one to cover pensions, one to cover healthcare costs and one to help pay down MPSERS debt. The percentage was capped at 20.96% in 2012 to prevent schools from paying an increasing percentage of payroll towards MPSERS debt. The state government pays the annual cost above that amount “off the top” of the School Aid budget. This equates to roughly $2 billion per year. MARSP supports this policy because it protects school budgets and ensures a steady stream of revenue to the pension system.

- Member contributions: Each employee pays a percentage of earnings into the system.

Statisticians (actuaries) make educated guesses (actuarial assumptions) to calculate how much money MPSERS needs to cover its total costs for all retirees. These guesses include lifespan, healthcare benefits, retirement dates, and payroll growth. The actuaries update their predictions to account for changes, such as increases in the average life expectancy in the United States.

But when reality doesn’t match the actuary’s guesses, debt results. Such debt is called unfunded actuarially accrued liabilities (UAAL). The UAAL is the difference between what the pension fund holds and what the system owes its retirees. The greater the UAAL, the more vulnerable the pension system is to fiscal instability.

For many reasons, we’ve at times seen more costs to the retirement system than funding. For example, when healthcare costs skyrocketed in the late 90s and early 2000s, so did MPSERS’s healthcare debt. Decreased contributions to the School Aid Fund in 2007, reduced investment performance in the 2008 financial crisis, enactment of early-out retirement packages in 2010, and payroll growth underperformance also contributed to the system’s accrual of debt.

We can think about MPSERS debt as we would a mortgage. If we fail to make timely payments on both interest and principle, the debt keeps snowballing. In 2008, the state put MPSERS’s debt on a fixed, 30-year repayment schedule. Since then reforms to MPSERS have reduced costs and prioritized the financial health of the system. The state has also made one-time and scheduled payments to reduce debt and system risk. This is akin to making extra mortgage payments when the cash is available.

In 2022, the Governor and Legislature negotiated a one-time $1 billion payment towards MPSERS debt in the 2023-2024 fiscal year. Many have wondered where that money came from and why it was one-time-only.

At the height of the coronavirus pandemic, the federal government provided Michigan with a significant “one-time” stimulus. While we may debate the reasoning and propriety of the stimulus, it allowed Michigan to make several historic investments. Since these funds were one-time-only, any yearly increase to MPSERS funding would have been unsustainable. For this reason, policymakers decided to put a large chunk towards debt.

Looking Ahead

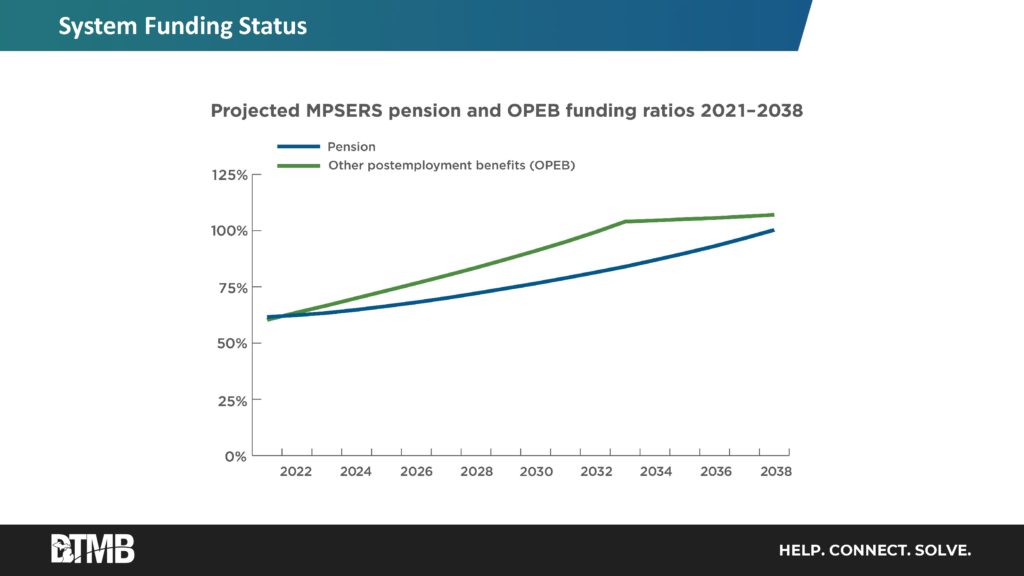

Empowered by members, MARSP keeps MPSERS financial health as a top priority among legislators. We may not agree with every reform enacted over the years, but the system is in much better shape than it was 15 years ago. As long as the 2008 repayment approach remains intact, MPSERS is on track to completely pay down its debt by 2038.

The Governor presented her proposal for the next fiscal year on Wednesday, February 7, 2024. The proposal included changes to pre-funded healthcare for MPSERS. MARSP is studying this proposal and following negotiations. Please stay tuned for further updates and calls to action.