The Bottom Line: As Income Tax Time Looms, PA-4 Provides Some Relief

Hess Bates, MARSP Treasurer

A new year is upon us with welcome increases in daylight and the opportunity to come up with some resolutions that we might actually keep (eat more chocolate, take more naps), or abandon forever (read that unabridged copy of War and Peace). It’s also the time when we begin to think about filing our federal and state income tax returns.

Income taxes have a long history in the good old US of A. Such taxes were first levied in 1861, repealed in 1872, and then permanently institutionalized during the early 20th century. An entire bureaucracy (the IRS) tasked with collecting the tax and a complex set of tax brackets have since become unwelcome parts of the national woodwork. And recognizing a lucrative gravy train when they saw one, the states were not far behind. Michigan first dipped sticky fingers into its citizens’ pay envelopes starting in 1967, adding a 2.6% nibble to the big bite taken by the IRS. For decades Michigan promised to insulate retiree pensions from the state’s income tax but in 2011 could restrain itself no longer, and retirees have been paying income taxes on their pensions ever since. Retirees screamed long and loud about the broken promises to no avail until Public Act 4 of 2023 (formerly HB-4001) was passed and signed into law in March of that year. PA 4 did not pass with sufficient support to take effect immediately, and will instead take effect 90 days after the Legislature’s November 14, 2023 adjournment.

VANGUARD first reported on PA-4 in its Spring, 2023 issue in an article penned by Chuck Abshagen, co-chair (with Georgia Sharp) of MARSP’s Legislative Committee. MARSP’s members indicated then that they were pleased with PA-4 because the tax on pension income was finally facing its sunset. But they were also disappointed that the law’s provisions phase-in over four lengthy years before all retirees will see its full effects. That four-year wait prompts a personal aside: Our Dear Old Mom taught her children that cynicism tends to make people…cynical…and that being cynical is not generally perceived as an attractive characteristic. Consequently, I shun cynicism in all of its guises and do not have even one cynical molecule in my entire body. Thus I find it unworthy of comment that in 2011 it took mere moments (legislatively speaking) to enact a tax on pensions that broke decades-old governmental promises, and now twelve years later it takes four years(!) to phase out that very tax. Again, I make no comment.

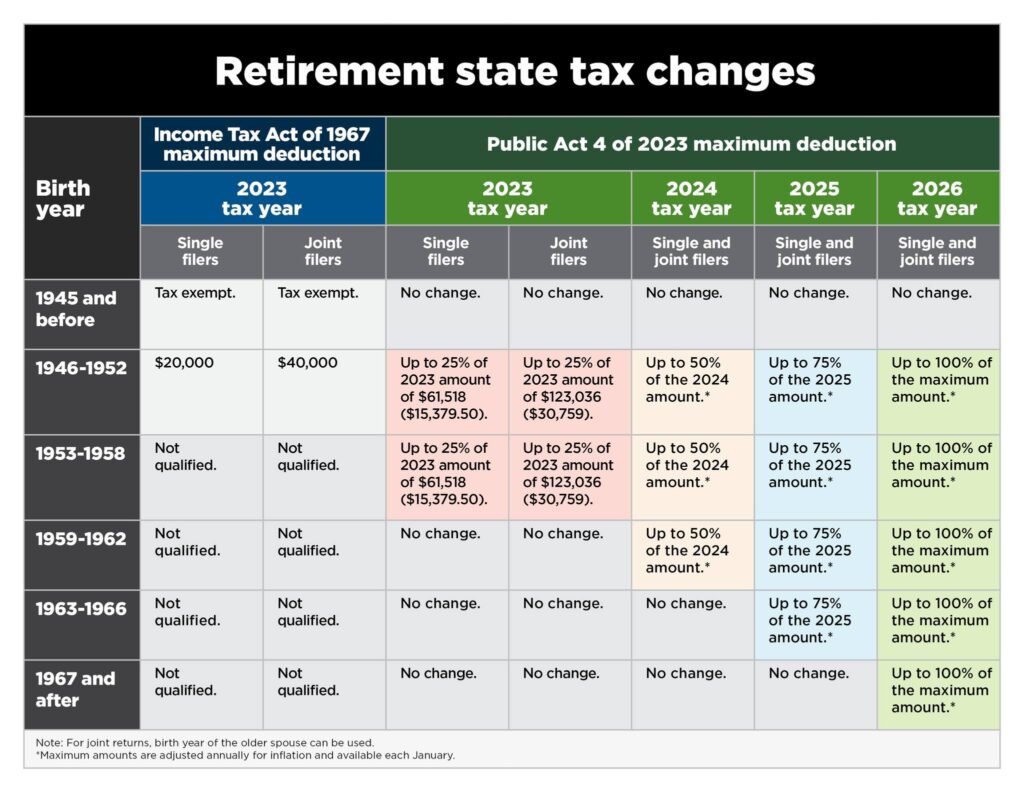

The table below, created by ORS, looks a little daunting but clarifies both year-of-birth qualifications and associated changes in pension income deduction limits provided by PA-4. The long and short of this is that as the next four years go by, more and younger taxpayers will become eligible to deduct increasing (by 25% per year) amounts of their pension incomes, with 100% tax relief (on a limit that will exceed most MPSERS pensions) for all retirees arriving in 2026. I suggest that you review this table with care to see how PA-4 affects your specific tax situation.

MARSP does not provide tax advice and neither do I. And we can depend on PA-4 to add its twists to the complexities of preparing tax returns that make tax season so entertaining. It therefore becomes incumbent on individual taxpayers to work with qualified tax professionals or to execute the necessary due diligence themselves, so that accurate returns are prepared. Perhaps Turbo Tax (and other such products) will make appropriate use of PA-4’s provisions…and perhaps not; in any case, both MARSP and I stress the importance of care and attention to detail when preparing tax returns.

The Bottom Line is that finally, starting in 2024 for the 2023 earnings year, many current retirees will see decreases in their state income tax liabilities. In that first year only a modest 25% of pension income will be exempt, and that only for older retirees. But at least we are taking steps in the right direction. And for that we can only say, “God bless us everyone!”

Click here to find more information regarding this law.