How Public Act 4 of 2023 Will Impact Retirement Income

On March 7, 2023, Governor Whitmer signed Public Act 4 (formerly HB 4001), amending the 2011 tax placed on retirement income and expanding Michigan Working Families Tax Credit. According to the Senate Fiscal Agency, “The bill would amend the Income Tax Act to allow a taxpayer, beginning in the 2023 tax year, to choose between the current limitations on the deductibility of retirement and pension income or the limitations specified in the bill.”

As sufficient support did not exist in the Legislature to allow the bill to take effect immediately, PA 4 will not take effect until 90 days after the Legislature adjourns for the year. While MARSP has long supported eliminating taxation of retiree income immediately, the political reality in Lansing is that PA 4 represented a final product that had the votes to pass.

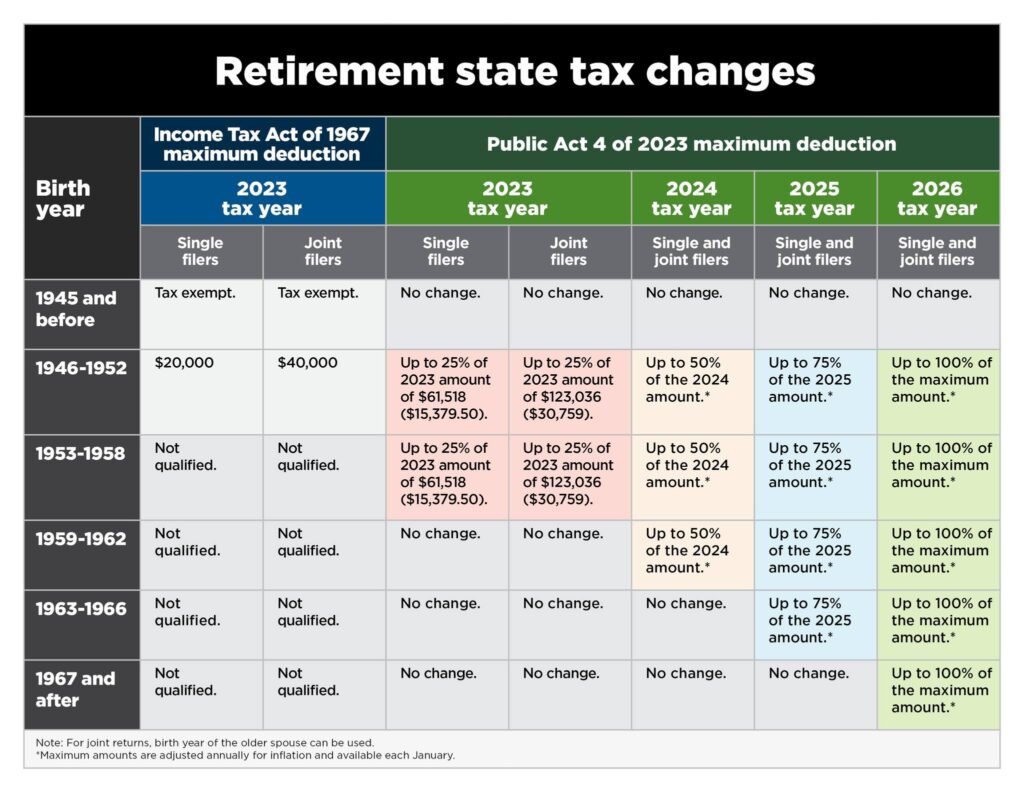

PA 4 of 2023 will phase out the 2011 changes to taxation of retiree income over the course of four years, beginning with the 2023 tax year (filed in 2024). According to the Office of Retirement Services (ORS), retirees who want to utilize the deductions available in PA 4 should file their 2023 tax return after the law’s effective date. If filing before the law’s effective date, an amended return can be filed after PA 4 of 2023 takes effect.

Those born in 1959 or after do not qualify for PA 4 limits for the 2023 tax year. As the law is phased in, additional retirees become eligible. By 2026, all ORS pensioners are eligible for the full deduction, regardless of age.

PA 4 allows retirees the option to choose between utilizing existing deductions or the new options (below).

Under PA 4, taxpayers can claim a phased-in tax deduction on retirement income as follows:

Again, taxpayers will retain the ability to choose annually between their current tax exemptions or the percentage phase-in.

Those born in 1945 or before

No change. Those born in or before 1945 remain fully exempt.

Joint returns

For a joint return, the proposed limitations and restrictions would have to be applied based on the date of birth of the older spouse filing the return.

If a deduction for pension benefits were claimed on a joint return for a tax year in which a spouse died and the surviving spouse had not remarried, the surviving spouse is entitled to claim the deduction in subsequent tax years with the same restrictions and limitations that would have applied based on the date of birth of the older of the two spouses.

More questions?

Click here to view PA-4 FAQs from the Office of Retirement Services.